This graphic represents the barriers people with intersecting marginalized identities experience regarding financial literacy. The graphic has a black background with an orange circle, holding the profile image of a Black person being "stopped" by a white hand.

For National Financial Awareness Day, TransLash Interviewed Trans Financial Advisor Andrea Romero

For National Financial Awareness Day, remember three important facts:

- Trans people can’t simply budget their way out of poverty.

- Allies can support economic justice for trans people by advocating for their own workplace to hire, train, and mentor trans people.

- There are steps that trans and LGBTQIA people can take to increase their financial literacy, reduce their debt, to save, and to invest — because economic freedom is also a trans right.

A survey of 2,000 Americans found they’re more likely to talk about politics and relationships with their friends than money. Financial literacy — the possession of the set of skills and knowledge that allows an individual to make informed and effective decisions with all of their financial resources — is a privilege that often comes with a level of financial security that many trans people do not have access to.

“We won’t be able to continue shattering glass ceilings for our community, especially our young future leaders, unless we help them build strong financial nest eggs as they begin their working lives,” says Jonathan Lovitz, senior vice president of the National LGBT Chamber of Commerce (NGLCC), in an interview with Forbes. “Only half of my fellow Millennial LGBTQ+ workers rate their current financial situation positively, with more than 60% saying their savings wouldn’t last more than three months.”

This guide by Team TransLash contains an interview with trans financial advisor Andrea Romero, guidance on next steps you can take today, and a round up of tools to help you reach your financial goals.

If You’re Feeling Financial Stress, You’re Not Alone

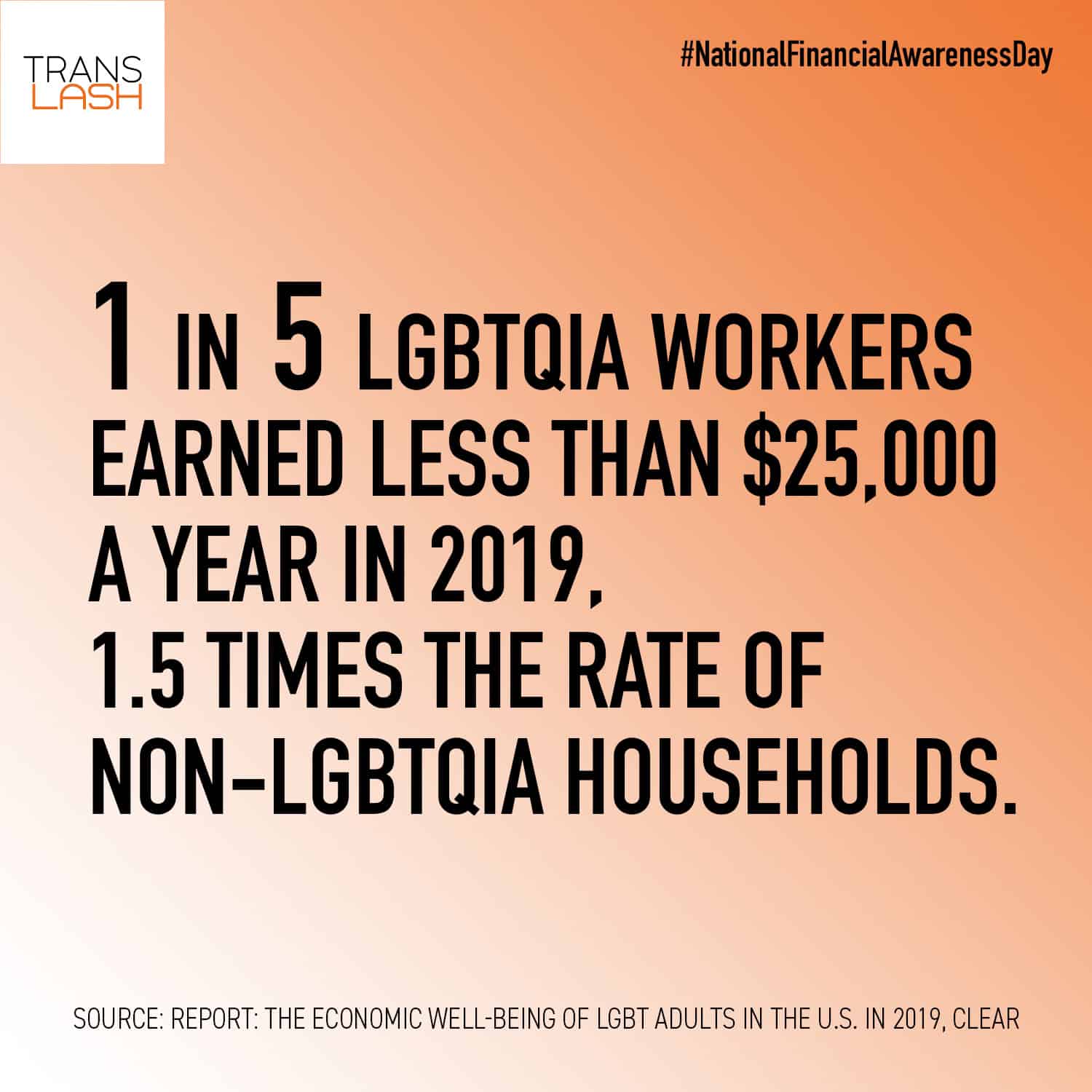

Classism (and often, transphobia) informs the problematic hot take that financial literacy alone can help trans and LGBTQIA people pull themselves out of debt by their bootstraps. The issue isn’t that trans people don’t budget enough, or don’t work hard enough: a report from the Center for LGBTQ Economic Advancement & Research found that 1 in 5 LGBTQ+ workers earned less than $25,000 a year in 2019, 1.5 times the rate of non-LGBTQ+ households. A 2015 survey by the National Center for Transgender Equality found that 29 percent of transgender people live in poverty. That’s more than double the 14 percent of the general U.S. population. And while working transgender men earn more after their transition, the average earnings of transgender women drops by nearly a third, according to a study published in the B.E. Journal of Economic Analysis & Policy in 2008.

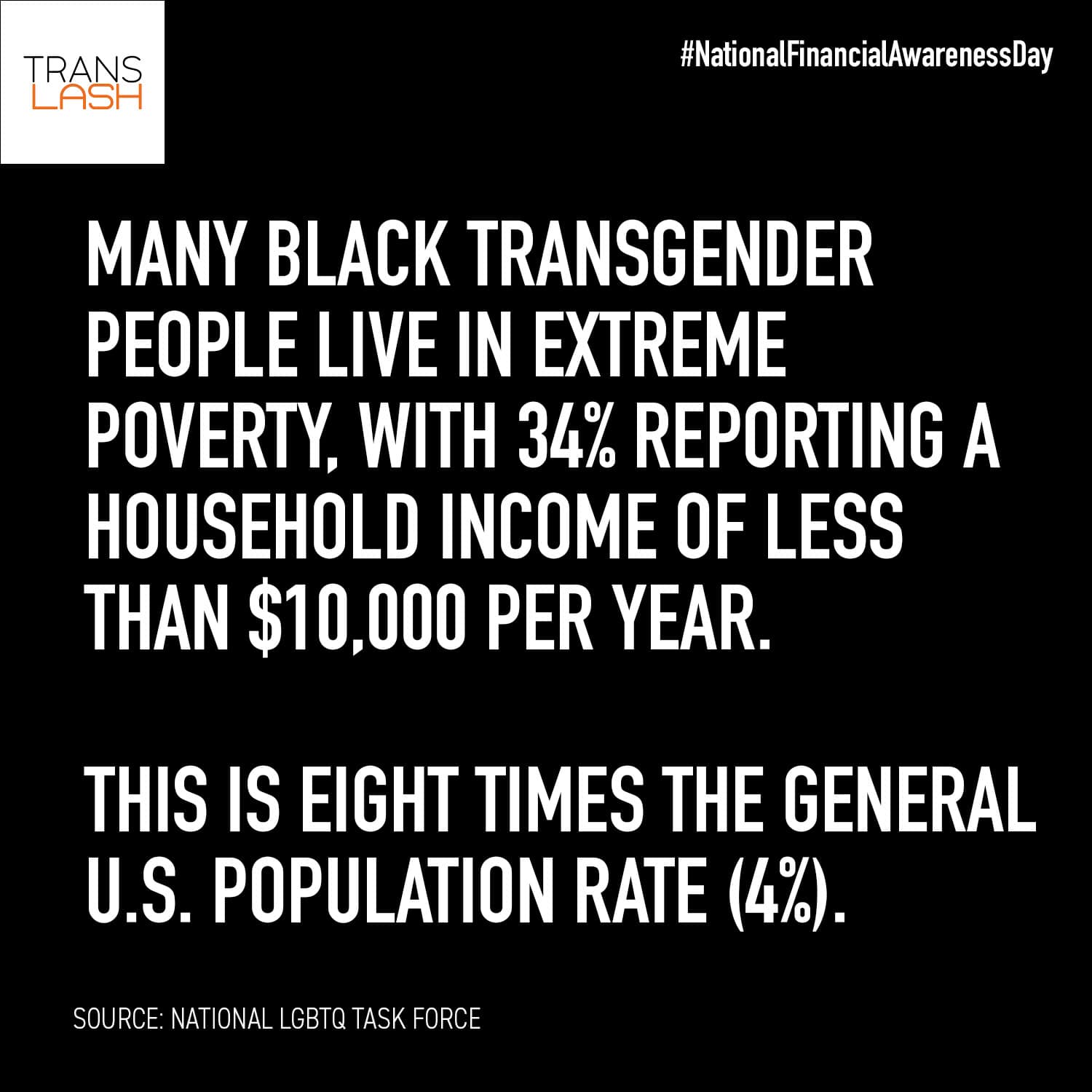

And even within the trans community, there are alarming disparities: Black transgender people live in extreme poverty, with 34 percent reporting a household income of less than $10,000 per year. This is more than twice the rate for transgender people of all races (15 percent), four times the general Black population rate (9 percent), and eight times the general U.S. population rate (4 percent).

According to the SAGE report, Out and Visible: The Experiences and Attitudes of Lesbian, Gay, Bisexual and Transgender Older Adults, Ages 45-75, nearly half of all LGBTQIA older people fear they will outlive the money they save for retirement, as compared to a quarter of non-LGBTQIA older people; 1 in 2 single LGBTQIA older people believe they will have to work well beyond retirement age, as compared to less than a third of single non-lgbt older people; and more than half of the LGBTQIA older adult population is concerned about not having enough money to survive retirement. Those seeking financial planning services may not understand the costs involved or know about affordable options — or may rightfully fear experiencing even more descrimination.

For all of these reasons and more, trans people deserve access to financial planning knowledge, services, and resources — regardless of their budget.

Q&A: Andrea Romero, Private Wealth Advisor

New Orleans, Louisiana — Daniela Capistrano sat down with Andrea Romero for TransLash Media to discuss Andrea’s own professional and financial journey — along with practical tips for trans people. Romero is a financial advisor with Faubourg Private Wealth Advisors, and a proud transgender woman.

DC: What are some challenges that are unique to the trans experience when it comes to budgeting, investing, and credit building?

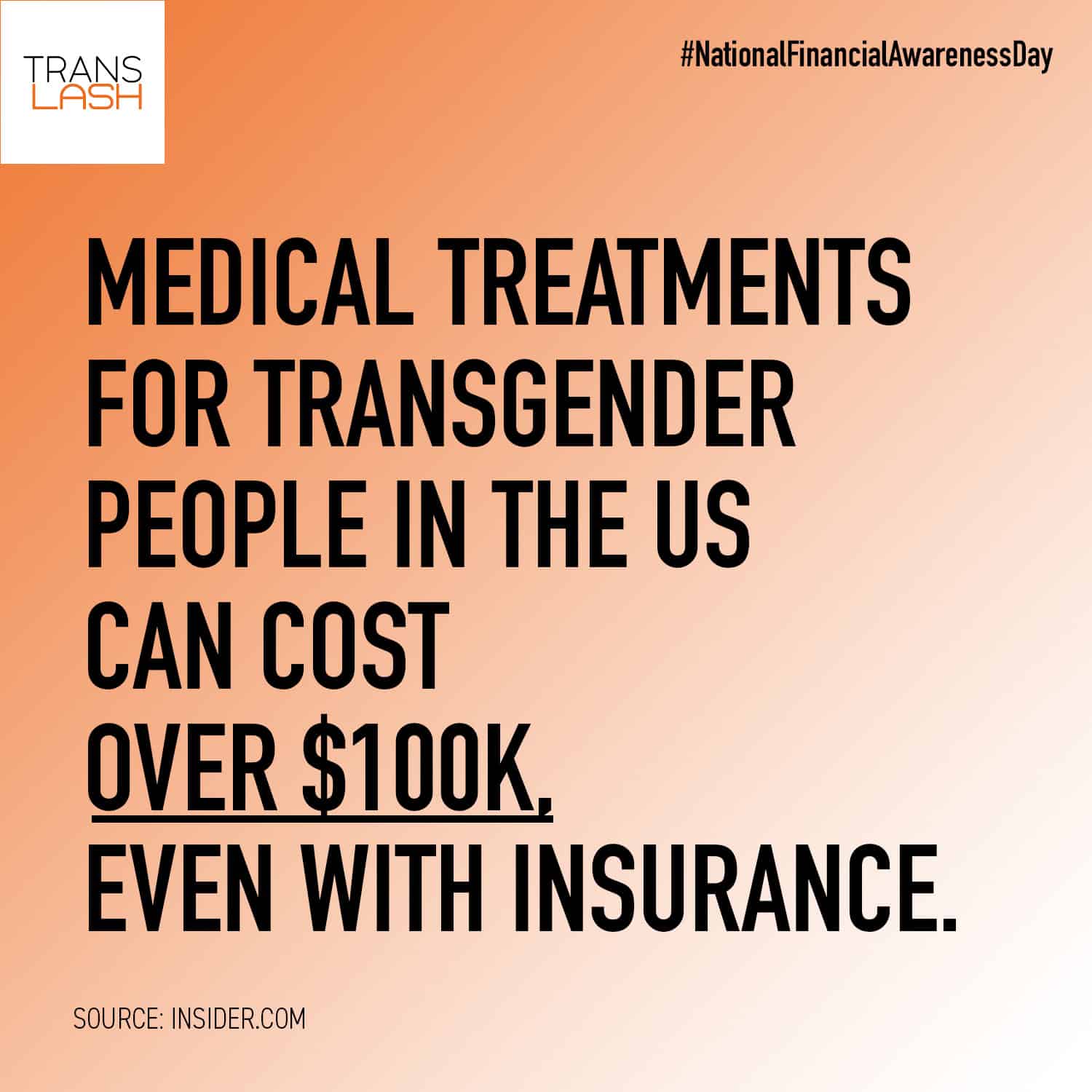

AR: The financial aspects of transition simply cannot be overstated. They pose a huge burden on individuals. For one, it’s insanely expensive, right? That has improved with expanding coverage by insurance and Medicaid, but clearly that helps only a fraction of those who need support. Even with coverage, it can cost a small fortune. And for many trans people, ongoing costs may never go away: hair removal, hair restorations, augmentations. Hormones, therapy, etc. The list of possible costs seems endless. Entire wardrobe makeovers are costly, especially for professionals.

Beyond dollars, trans people spend a lot of time and energy on transition—resources that may be taking from their economic earning power as well. All the hours of therapy, electrolysis and voice lessons — I know they affected my work productivity for a number of years.

Then there is the embedded misogyny and transphobia of the employment sector. It is harder for trans people to get hired, which immediately impacts their wealth-building capacity as well as their later-in-life Social Security payments, which are based on your salary over your lifetime. The bottom line: one’s lifetime income may be impacted by transition, and transition can be a permanent set-back financially in terms of your ability to fund other key goals, too—things like paying for college, saving for retirement, buying a home, etc.

The good news in all this: that we are even talking about trans people investing for retirement, or for children and grandchildren, or buying life insurance and running their own business. Two decades ago, we weren’t even talking about living out our lives.

I work with many LGBTQIA business owners here in New Orleans, Louisiana. Several have told me outright that they never saved for retirement because they never thought they would live long enough to use the money. These are queers who grew up in communities ravaged by HIV and AIDS. Now they need the money, and they have a lot of work to do to catch up in a short amount of time. In many ways, I feel like the trans and non-binary movement is where the gay community was. I have two trans clients who said the same thing; they are only now thinking about retirement planning because they presumed they would be dead by now.

It is one reason I love my job, because it is important that we have professionals who support us without judging us.I know it matters to my clients — whether gay, lesbian or trans — that they can tell me anything about their life, dreams, backgrounds or money challenges.

DC: What are some things you wish you knew early on in your own financial literacy journey?

AR: Credit building is so fundamental. When I got into college, I suddenly was swarmed with “pre-approved, free credit card” offers — all at huge interest rates, mind you. And of course I fell for them and started a long relationship with debt as a result. Credit cards can be hugely beneficial for ease of transacting, especially in emergencies, but it is important to pay that balance in full every month. Credit cards function as IOUs, so if you don’t like owing people, try not to use them. But what happens for so many is that bad borrowing or credit practices lead to “bad credit” in the form of low credit scores. Everyone has a credit score, or a rating on their risk of repayment as a borrower. You need to protect your credit score, and that starts with avoiding dangerous habits.

– Use free tools such as the Credit Karma app to see your free credit scores, reports, and personalized tips and tools to help you build your credit.

– Nonprofit credit debt counseling services such as Credit.org (and debt relief programs) can help you with creating a plan that works with your budget.

– Apply for a secured credit card or other credit building card to help increase your credit score.

AR: Credit and deadnames: both can be key obstacles for trans people. Your credit and financial identity is one that follows you your whole life, so it is also an easy place to be deadnamed, yes. Changing one’s name is a complex process. It can be frustrating. Believe it or not, just this year Equifax and the other credit agencies made it possible for trans people to change their name on their credit history. Previously everytime a credit report would be run—which is more often than you might think; credit cards, yes, but for employers, landlords, finance companies, and others—an applicant would be deadnamed. That gets exhausting.

Equifax has created a page on their website for navigating the process to change names on credit reports. Before requesting a name change on their credit report, consumers must first have obtained a legal name change through the courts.

AR: Another important lesson is saving. After covering your essential living costs, you should prioritize saving for specific financial goals. If you don’t have anything left to save, then consider finding a side-hustle. Many financial personal financial coaches talk about thinking of cash flow in terms of buckets: one for core needs, one for short term emergency saving, one for long term savings like retirement — and then what’s left is discretionary money. There are many systems to “fool” yourself into saving. Whatever it takes, do it.

– The Acorns app can help you to slowly but surely set money aside for your financial goals.

– Open a high-yield savings account: Chime and Ally Bank are trusted options at a .50% APY (annual percentage yield). Your savings account at Chase or Wells Fargo, for example, only earns you .01%.

AR: Slow and steady wins the race. There is a proverb that says “Be not afraid of going slowly, be afraid of standing still.” My first real investment was my 403b retirement account when I worked in nonprofits in Washington DC in the 1990s. I knew I wanted the company’s matching dollars, so I started making small contributions–$25, $50 a month. It might seem like those amounts would make little difference, but the power of compounding is one of the greatest forces on earth, to paraphrase Albert Einstein. And the earlier one invests, the more compounding one can expect over time.

– Compound interest is what happens when you reinvest your earnings, which then earn interest as well. Compound interest essentially means “interest on the interest” and is the reason many investors are so successful.

– Here are seven compound interest investments that can boost your savings.

AR: It’s never too late to invest. When it comes to investing, which is one of my passions, I think there are always opportunities for both short term and long term gains — but your timeframe should be an important consideration in how much risk you take in your investments. For people saving for short term goals like gender-affirming surgeries, I say be careful. Using a strategy like “dollar cost averaging”, however, can be effective. That’s where you invest the same amount weekly or monthly into the same stock or other security for a period of time. It can be a better alternative than trying to save enough to invest and then risking buying high. Of course, one should trust a professional, or be prepared to do a good amount of homework before doing any investing. But with a timeframe of two or three years, a sensible investing plan for savings could help toward those surgical costs as well.

Crowdfunding for gender-affirming surgery is another strategy to consider, in addition to investing or saving. Here are some tips for running a successful crowdfunding campaign.

DC: What are some free online resources that you recommend folks bookmark and check out to support their own financial literacy education?

AR: I love Investopedia. They make the complex easy to understand, and that is always my goal with clients. Bloomberg is a fabulous way to stay informed of the markets and investing. Kiplinger is pretty good, too, for a typical personal financial source.

As we come into our own as the LGBTQIA community, others are providing new ways of looking at our common financial concerns. I am a big fan of the folks at the Center for LGBT Economic Advancement and Research (CLEAR) and the Williams Institute at UCLA Law School. Their message of economic sustainability is one that I really believe in. The more we can help the trans community and the larger LGBTQIA community to become financially self-sufficient, rather than excluded from jobs and financial freedom, then we will see far fewer worse case scenarios—like homelessness, addiction, self-harming, and so forth. We all want the same things in this life: happiness, health, and wealth — when I use the term wealth, I mean the ability to have money working for us instead of only us working for the money — enough to be neither dependent on others nor at risk of being unable to provide our needs.

DC: How did you end up in your professional journey as a financial advisor, and how does being trans inform the work that you do?

AR: I work as a wealth planner, which is a fancy way of saying I’m a personal financial advisor. I work to create tailored solutions to big financial and investing needs using a goals-based approach, with a focus on being tax-wise and fee-conscious. My firm is named Faubourg Private Wealth Advisors. As Faubourg, I run my own practice and have full discretion over whom I work with and how I build my business. I work with clients of all types and stripes, across the nation, but I especially enjoy working with women, trans and queer LGBTQIA clients, and nonprofit organizations. My firm and my colleagues fully support the work I do to put more “green” in the rainbow community, so to speak. We all deserve professional financial help, and I am so proud of the work we do to deliver.

I graduated college with a degree in theology, wanting to change the world. As an environmentalist I cut my teeth on campaigning for action in the face of global climate change—this was in 1992, mind you, and Al Gore’s Earth in the Balance had just been released. I spent a decade working on wildlife conservation programs, primarily running an international grant-making program, which led me to work in grant-seeking and individual major gift fundraising.

Engaging with wealthy donors made me realize that very few are lucky to be born or even work their way into that kind of wealth. Most of us have to work to both create wealth AND to avoid the mistakes that can compromise long term financial security.

Those lessons motivated me to switch fields entirely, and focus on helping individuals and families with their personal wealth building needs and financial goals. I began my training to become a licensed stockbroker and financial advisor. I wanted to help build capital and income for people to invest in their own values and needs.

It was not an easy decision to make. I was trying to save my marriage while also on the last stages of a 30 year journey of denial as to being trans. So I pretty much switched careers and began training for my series 7 and 66 licenses, which are a big deal, while my marriage imploded.

I came out and began transition, sold our dream house, legally separated, and also had two young daughters under the age of three—all while building a career and business from scratch. Those first few years were tough, but I love what I do. I feel more directly helpful in people’s lives and well-being than I ever did in two decades of nonprofit and philanthropic work.

Being trans has made my career all the more challenging. When I transitioned—in full view of all my clients, mind you— I lost a few of them. I also learned the hard way that some companies say they support their trans employees, but they have no idea what supporting us really means. “Rainbow-washing” in corporate culture is a real thing. So I suppose humility has been a great lesson in all this. Empathy is a useful skill in this industry as well. People want to know you care before they care about what you know. I think the fact that I myself have struggled, endured, lost so much, spent so much to become authentic and finally genuine—all that matters to people who want a relationship, whether they are LGBTQIA or otherwise. I care, and people feel it.

DC: What advice do you have for others who are interested in a career as a financial advisor?

AR: One of the most important ways people choose with whom to do business is by shared interests, lifestyles, and beliefs. We need more advisors who reflect America today. There are many time-tested ways to build wealth, and what we need are more trusted-advisors from all segments of our society. There are far too few Black and POC financial advisors in this country, in my opinion. There are too few female advisors, and there are certainly too few trans and LGBTQIA financial advisors as well. So to anyone reading this, I would say we as a community need more financial planners and investment advisors who look like us.

Working with individuals and small businesses involves numbers and complex ideas, sure, but above all else, this is a people business. You have to be able to communicate, simplify the complex, and build trusted relationships. You have to be willing to work with people. So if you are serious, start with getting your securities licenses. You can do it yourself and take your own licensing coursework and exams, or find companies who will screen applicants to find talent that they then train for licensing and client work. Both are good paths to getting started. And if you like the topic of finance and investing but are skittish about working directly with people, consider becoming a financial analyst.

– How To Become A Financial Advisor Without A Degree, Indeed

– How To Become A Financial Analyst: Things To Know, Investopedia

Transgender Economics: Must-Reads

- Wells Fargo and ideas42, a leading nonprofit that uses insights from behavioral science to drive social change, announced Shared Prosperity Catalyst, a $15 million collaboration funded by Wells Fargo that aims to increase pathways to economic opportunity and advancement in the United States. Dr. Kortney Ziegler, a Black transgender social entrepreneur from Oakland, California, is developing a platform to help underbanked individuals access instant funding for life emergencies. Ziegler’s most recent business, Appolition, enabled incarcerated people to afford bail so they could return to their families and livelihood. Learn more.

- For Many In The Trans Community, Basic Financial Goals Are Out Of Reach, HuffPost

- Transgender Americans are more likely to be unemployed and poor, The Conversation

- PAYING AN UNFAIR PRICE: The Financial Penalty for Being Transgender in America (February 2015), Center for American Progress

- LGBTQ Millennials: “American Dream” tough to achieve by 40, survey reveals, USA Today

- For every $100 awarded by US foundations, only 4 cents focuses on trans communities. Grantmakers United for Trans Communities (GUTC), an initiative of Funders for LGBTQ Issues, aims to inspire a philanthropic culture that is inclusive and supportive of trans people through grantmaking and decision-making.

- What Constraints Financial Inclusion for the Transgender Community? Field-based Evidences from Odisha (India), SAGE Journals

Professional Development & Financial Resources For Trans People

- LGBTQ Personal Finance Advice, Nerdwallet

- TransTech is “an incubator for LGBTQ Talent with a focus on economically empowering the T, transgender people, in our community.”

- Association of Transgender Professionals Facebook group: “Without financial equality, there can be no equality. This is an association of people who have, had or will have non-conforming gender expressions/identities and seek to advance their professional careers. The goal of this group is to facilitate the networking and mentoring which develop our careers and promote the next generation of leaders.”

- NGLCC | National LGBT Chamber of Commerce: the business voice of the LGBT community, and the only national advocacy organization dedicated to expanding economic opportunities for the LGBT business community. NGLCC is the exclusive third-party certifying body for Certified LGBT Business Enterprise® (Certified LGBTBE®) companies. Over 1/3 of Fortune 500 recognize this certification and partner with NGLCC to create fully LGBT-inclusive supply-chains.

- Astrea Grants: Learn about funding opportunities for trans & LGBTQIA people in their U.S. Fund, International Fund, Intersex Human Rights Fund, and Global Arts Fund.

- Mutual Aid and Emergency Funds, National Center for Transgender Equality

- Microgrants by Trans Lifeline provide trans and nonbinary people with low-barrier funds and support to correct names and/or gender markers on identifying legal documents, access trans health care, and necessities for our trans siblings behind bars.

- Check out Team TransLash’s COVID-19 Trans Resources Directory, featuring a variety of funding options and other forms of support.

About Andrea Romero, Private Wealth Advisor

Andrea Romero works as a licensed financial advisor in New Orleans, where she partners with clients to help plan for their biggest financial goals using a comprehensive approach and time-tested methods of personalized wealth-building. Her focus on helping clients develop plans for retirement income includes tax-wise planning, insurance protection and estate planning as well. Andrea holds her FINRA series 7* and 66* licenses along with her life and health insurance licenses.

Prior to joining Faubourg Private Wealth, Andrea spent six years as a financial advisor with Edward Jones, where she established a new branch office. Andrea believes in giving back through a variety of ways, a testament to her firm belief in the importance of philanthropy.

Before joining the financial services industry, Andrea spent two decades in nonprofit grant-making and fundraising at several distinguished charitable organizations, including the American Red Cross, Tulane Law School, Georgetown University, the National Audubon Society and the National Fish and Wildlife Foundation, where she managed grant programs in support of wildlife habitat conservation and NGO partners across the Mesoamerica and Caribbean region. She dedicates much of her time to supporting local charitable causes.

A member of the Gulf South LGBT Chamber of Commerce, Andrea also recently concluded her service as Board Member of the PFLAG New Orleans Chapter and chair of the PFLAG New Orleans Scholarship Committee. She also serves the executive committee for the Bricolage Academy Community Association.

Tenth generation Louisianan, Andrea grew up in Lafayette and earned her Bachelor of Arts from Georgetown University in Washington, DC. In her spare time, Andrea enjoys all that New Orleans offers, practices pilates, marches as a member of the NOLA Cherry Bombs, and spends as much time as she can with her two young daughters in their New Orleans home.

I believe everyone deserves sound, reliable advice to plan for their retirement income needs. I enjoy helping clients by making the complex easy to understand and managing the worry from their investing so they can enjoy life and invest in their other values. Whether for individuals or nonprofit institutions, money is security, and I work hard to help families and clients feel confident in their goals. What is most important for them is what drives me, and what is best for them is what guides our planning and choices.

Andrea Romero

Did you find this resource helpful? Consider supporting our work today with a tax-deductible donation.